🙌 Pradhan Mantri Mudra Yojana 2025: A Lifeline for Small Business Dreams

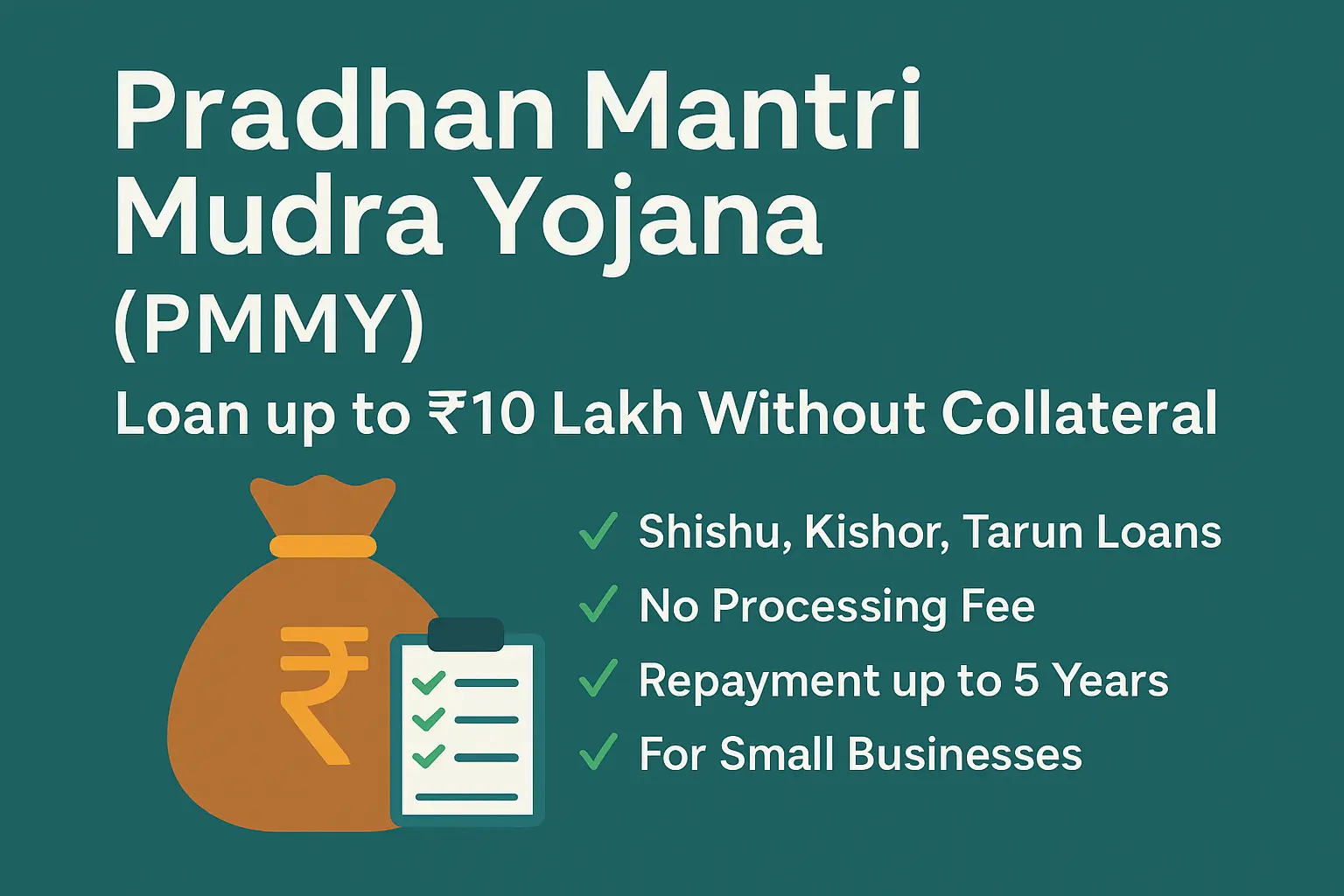

Pradhan Mantri Mudra Yojana loan Apply Online 2025: Get up to ₹10 lakh without collateral. Check eligibility, documents & application process now.

Have you ever dreamed of starting your own small business but couldn’t because of money?

Or maybe you already run a small shop or service but want to expand?

The Pradhan Mantri Mudra Yojana (PMMY) is here to help people like you. Launched by the Government of India, this scheme provides loans up to ₹10 lakh without any collateral—yes, you heard that right—no property or security needed.

🧾 What is PMMY, and Why Was It Started?

Pradhan Mantri Mudra Yojana Loan Apply Online 2025 : Back in April 2015, the government realized that small businesses—like tailors, tea sellers, carpenters, mechanics, vegetable vendors, or even tuition teachers—often struggle to get loans from banks. The paperwork is complex, and collateral is usually required.

To solve this, the Micro Units Development & Refinance Agency (MUDRA) was created. Under the Mudra Yojana, any individual with a small business idea or an existing setup can apply for a loan from banks, NBFCs, and even microfinance institutions.

No need to be rich. No need to be highly educated. Just have an idea and the will to work.

🎯 What’s the Purpose of This Scheme?

- To help ordinary people become entrepreneurs

- To support small businesses that keep our economy alive

- To generate employment at the local level

- To make loans accessible, affordable, and stress-free

🧩 Types of Mudra Loans – Know Your Category

Depending on how big your business is and what stage it is in, you can apply under these 3 loan categories:

| Category | Loan Amount | Best For |

|---|---|---|

| Shishu | Up to ₹50,000 | People just starting out—like buying a sewing machine, setting up a food stall, or starting delivery service |

| Kishor | ₹50,001 to ₹5 lakh | For those looking to grow—buying a secondhand vehicle, shop renovation, etc. |

| Tarun | ₹5 lakh to ₹10 lakh | For expanding businesses—opening a second branch, new equipment, hiring staff, etc. |

Each category is a stepping stone. Many who start with a Shishu loan can later qualify for Kishor and Tarun.

🧠 Who Can Apply?

This scheme is for any Indian citizen who is:

- Running a small business (formal or informal)

- Looking to start something new

- Between the age of 18 and 65

- Has a solid idea and is willing to work hard

Examples:

- Tailors, kirana store owners, plumbers

- Auto drivers, carpenters, mobile repair technicians

- Women opening beauty parlors or tiffin services

- Youth starting YouTube-based services or digital printing

📋 What Documents Do You Need?

Here’s the simple checklist:

- Aadhaar Card & PAN Card

- Photograph

- Proof of business idea or existing activity

- Bank statement (if existing account)

- Business registration (if applicable)

- Quotation or bill for equipment you want to purchase

- Address proof

👉 Don’t worry if you’re unsure. Most banks and MFIs will guide you.

💰 What Are the Benefits?

- ✔️ Collateral-free loan

- ✔️ Affordable interest rates (varies, approx. 8%–12%)

- ✔️ Flexible repayment tenure (up to 5 years)

- ✔️ No processing fees for Shishu loans

- ✔️ Support for women and SC/ST/OBC entrepreneurs

- ✔️ Helps build a credit score for future loans

🖥️ How to Apply for Pradhan Mantri Mudra Yojana Loan Online 2025

Step-by-Step Guide

Here’s how you can apply online for a Mudra loan in 2025.

✅ Step 1: Visit the Official Mudra Website

Go to https://www.mudra.org.in.

This is the official website of MUDRA Ltd. (Micro Units Development and Refinance Agency), the government body behind this scheme.

Here you’ll find all the resources, loan categories (Shishu, Kishor, Tarun), documents required, and bank partners.

✅ Step 2: Choose Your Preferred Lending Institution

Mudra loans are provided by:

- Public sector banks (SBI, PNB, BoB, etc.)

- Private banks (ICICI, Axis, HDFC)

- Regional rural banks

- NBFCs and Micro Finance Institutions

👉 Visit your chosen bank’s official website or their branch directly.

✅ Step 3: Prepare These Documents

Before you apply, keep these documents ready:

- Aadhaar Card and PAN Card

- Passport-size photographs

- Proof of identity and address

- Bank statement (last 6 months if applicable)

- Business proof or business plan

- Quotation/invoice for machinery or equipment

- Registration/license (if your business has one)

No need to worry if your business is informal—a well-written business plan is enough to start with Shishu loans.

✅ Step 4: Fill Out the Mudra Loan Application Form

You can:

- Download the PDF form from the official website:

📄 Download Mudra Loan Application Form (PDF)

OR

- Apply online via your chosen bank’s portal (some banks allow full digital applications)

The form includes:

- Your personal details

- Business details (new/start-up or existing)

- Loan amount and purpose

- Income and expenses (if applicable)

✅ Step 5: Submit the Form with Documents

You can submit the form either:

- Online (if applying via bank portal), or

- In person by visiting the nearest branch of your bank

The bank will:

- Verify your application and documents

- Evaluate your business plan

- Check your credit history (if any)

- Decide on loan approval

🕐 Timeline: Most applications are processed within 7 to 15 working days

✅ Step 6: Get Your Loan and Use It Right

Pradhan Mantri Mudra Yojana Loan Apply Online 2025: Once approved, the amount is disbursed directly to your bank account. You will also be issued a MUDRA Card (like a RuPay debit card) linked to your loan account.

Important: Use the funds strictly for business—like equipment purchase, shop setup, working capital, raw materials, etc.

✍️ Application Process:

- Prepare your business idea

- Fill the Mudra loan application form

- Attach required documents

- Submit to a bank branch or apply online

- The bank verifies your details and approves the loan.

⏳ Approval time can range from 2 days to 2 weeks, depending on the lender.

- ✔️ Ask the bank about interest rate and repayment schedule

🏦 Apply Online Directly from Bank Websites

Here are some direct links to major banks that provide Mudra loans:

| Bank | Online Application Link |

|---|---|

| SBI | https://sbi.co.in |

| Bank of Baroda | https://www.bankofbaroda.in |

| PNB | https://www.pnbindia.in |

| ICICI Bank | https://www.icicibank.com |

| HDFC Bank | https://www.hdfcbank.com |

You can apply through:

- Public sector banks like SBI, Bank of Baroda, PNB, etc.

- Private banks like HDFC, ICICI, Axis Bank

- NBFCs, Cooperative banks, Microfinance institutions

- Online at: https://www.mudra.org.in

📈 Real Impact of Mudra Yojana

Since its launch, PMMY has:

- Disbursed over ₹25 lakh crore in loans

- Benefitted over 45 crore small entrepreneurs

- Empowered women (nearly 70% of borrowers are women!)

- Created millions of local jobs

And the best part? Many small businesses that were struggling to survive are now thriving.

📌 Tips Before You Apply

- ✅ Have a clear idea of what you want to do

- ✅ Start with a small loan if unsure

- ✅ Maintain a good repayment track to grow further

- ✅ Use the money strictly for business (not personal expenses)

❓ FAQs About Mudra Yojana

Q1. Do I need to provide any property or security?

👉 No, loans under Mudra Yojana are 100% collateral-free.

Q2. Is there any subsidy in this scheme?

👉 No subsidy directly, but interest rates are low and affordable.

Q3. I’m unemployed—can I apply?

👉 Yes, as long as you have a viable business idea.

Q4. Can women apply?

👉 Absolutely! In fact, many banks have special provisions or priority for women entrepreneurs.

Q5. How many times can I apply?

👉 You can apply again in a higher category (Kishor/Tarun) after successfully repaying your previous loan.

🔚 Final Words

The Pradhan Mantri Mudra Yojana isn’t just a government scheme—it’s a gateway to independence, confidence, and growth for every aspiring entrepreneur.

Whether you’re a college dropout with a digital idea, a homemaker with a tiffin plan, or a youth from a small town with big dreams—PMMY gives you the financial push you need to begin.

🎯 Don’t wait for opportunities. Create them with Mudra.

2 thoughts on “Easy & Secure: Pradhan Mantri Mudra Yojana Loan Apply Online 2025 – Get Up to ₹10 Lakh Without Collateral”