1. What Is Pradhan Mantri Jan Dhan Yojana 2025 In Simple Words?

Pradhan Mantri Jan Dhan Yojana 2025: The greatest financial inclusion initiative in India was introduced in 2014 under the Pradhan Mantri Jan-Dhan Yojana (PMJDY). It seeks to guarantee that all Indians, even those without a single rupee in their pockets, have access to banking services.

Under PMJDY, you get:

- A zero-balance savings account (yes, zero!)

- A RuPay debit card with free accidental insurance

- Access to overdrafts after active use

- Life insurance if the account was opened in the early stages of the scheme

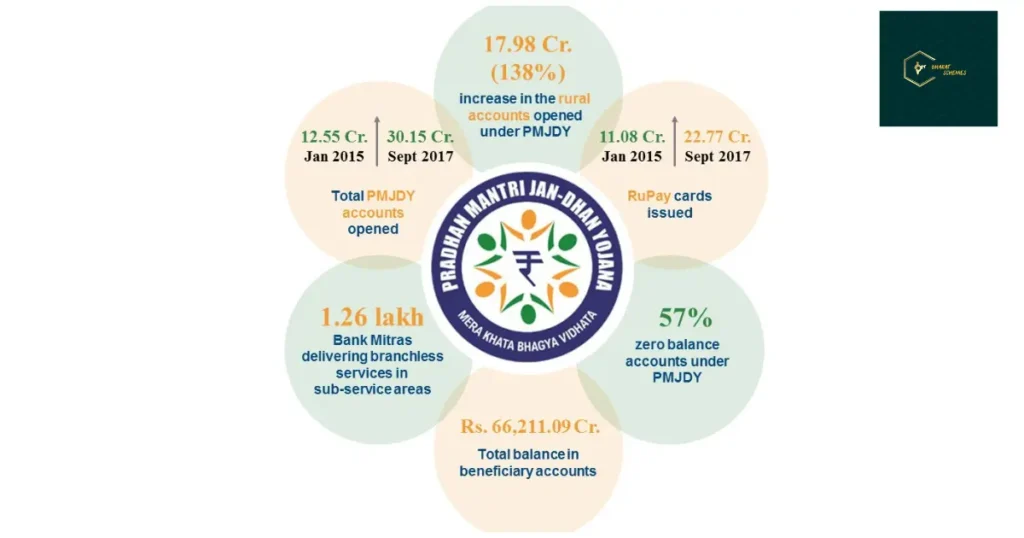

By 2023, the scheme had clocked in over 50 crore accounts and issued 36 crore RuPay cards. This is not just policy—it’s progress.

🧾 Key Features of PMJDY Accounts

| Feature | Details |

|---|---|

| Account Type | Savings Bank Account (Zero Balance Allowed) |

| Age to Apply | 10 years and above |

| Minimum Balance | Not required |

| ATM/Debit Card | Free RuPay Debit Card issued |

| Interest on Savings | Yes (as per bank policy) |

| Overdraft Facility | Up to ₹10,000 (after 6 months of good conduct) |

| Accidental Insurance Cover | ₹2 lakh (RuPay card holders) |

| Life Insurance Cover | ₹30,000 (for accounts opened before 31 Jan 2015) |

| Direct Benefit Transfer (DBT) | Yes—LPG subsidy, pension, scholarships, etc. |

2. Why It Still Matters in 2025

A. Real Inclusion

PMJDY has made it possible for millions of rural families to access a bank without needing to migrate to cities.

B. Digital Push

Thanks to the RuPay card, Aadhaar, and mobile link-up (the JAM trinity), beneficiaries get subsidies directly in their accounts and can transact cash-free.

C. Safety Net

The accidental insurance cover of ₹2 lakh and life insurance options offer a layer of security for the underprivileged.

D. Economic Impact

Crores in savings through Jan Dhan accounts have added to the formal economy, enhancing India’s banking system.

3. Who Can Open a PMJDY Account?

- Any Indian citizen aged 10 and above (minors need a guardian)

- Only one PMJDY account per person

- If you don’t have Aadhaar or ID, you can still open a Small Account with a self-declaration

Best part? No minimum balance required. It’s truly for everyone.

4. How to Open a PMJDY Account in 2025

A. Online or Not?

Pradhan Mantri Jan Dhan Yojana 2025: You cannot open it entirely online. But you can fill some basic details online and finish the process by visiting a bank or Bank-Mitra (local banking correspondent).

B. What You Need

- Aadhaar or any valid government ID

- One passport-size photo

- A mobile number

- Guardian details (if minor)

C. Step-by-Step Guide

- Visit your nearest bank branch or Bank-Mitra

- Fill the BSBD account form

- Submit your documents for KYC

- Collect your RuPay debit card

- Set a PIN and activate SMS alerts/NetBanking

For Small Accounts, you only need a photo and signature/thumbprint.

D. Activating Your Benefits

- Make at least one transaction in 45 days to activate accident insurance

- Use your account actively for 6 months to get overdraft eligibility (up to ₹10,000)

- Even non-financial activity counts to keep insurance valid

5. Full Benefits of the PMJDY RuPay Card

1. Universal Use

Use it at ATMs, retail stores, or online platforms across India.

2. Free Insurance

✔₹2 lakh accident insurance (if issued after Aug 2018)

3. Contactless Transactions

Tap and pay up to ₹5,000 (3 times daily) without entering a PIN

4. Quick, Secure & Low Cost

Domestic routing makes it fast and cheap; KYC reduces fraud.

5. Cashback & Rewards

Get exclusive discounts, cashback offers, and reward points

6. Overdraft Facility

Access emergency funds of up to ₹10,000

7. SMS & USSD Banking

Check balances or send money from even a basic feature phone

8. Add-on Insurance Schemes

Sign up for PMSBY (₹2 lakh accident) and PMJJBY (₹2 lakh life cover)

6. Frequently Asked Questions (FAQs)

Q1. Can I open a Jan-Dhan account without Aadhaar?

Yes. You can use any other officially valid document (like voter ID, PAN, etc.)

Q2. Can I have a Jan-Dhan account and a normal savings account?

Yes, but only one Jan-Dhan account is allowed per person.

Q3. What happens if I don’t keep money in the account?

The account remains active, but you may lose some benefits like overdraft eligibility if there’s no activity for months.

Q4. Is the insurance automatic?

The accidental cover on the RuPay card is automatic, but you must use the card at least once in 90 days to keep it active.

7. Ground-Level Impact

- Subsidy Direct: Farmers now get benefits like Kisan Samman directly in their accounts

- Emergency Lifeline: Families got the ₹2 lakh accident insurance after fatal mishaps

- Empowered Women: Rural women use RuPay cards for daily needs and savings

8. What Needs Work

- Dormant accounts: Around 20% are still inactive

- Awareness gap: Many users don’t realize they have insurance or OD access

- Bank strain: Mass KYC has overwhelmed rural branches at times

9. The 2025 Update: What’s New

- Usage focus over account count

- Push for insurance enrolment through PMJDY

- More Bank-Mitras & micro-ATMs

- Digital literacy campaigns for rural users

Read more :

10. Wrap-Up: The Power of PMJDY

PMJDY has moved India from “no bank” to “bank for all.” It’s more than just a free account; it’s a gateway to dignity, safety, and digital empowerment.

Take Action Today

- Gather your Aadhaar & mobile number

- Visit the nearest bank or Bank-Mitra

- Open your zero-balance account

- Activate your RuPay card

- Keep your account active

- Track your benefits (insurance, overdraft, rewards)

- Upgrade when eligible

🔗 Important Links

You’re not just opening an account. You’re stepping into India’s digital future.

1 thought on “Pradhan Mantri Jan Dhan Yojana 2025: How to Open Zero Balance Account Online & Get RuPay Card Benefits”