📌 Introduction – Why APY Matters for India’s Future Retirees

Atal Pension Yojana 2025 : In India, a large portion of the working population, especially in the unorganised sector, spend their entire lives working without any retirement savings. When they get older and can no longer work, many struggle to meet basic expenses like food, healthcare, and shelter.

To address this, the Government of India launched the Atal Pension Yojana (APY) in 2015 — a social security scheme that ensures a guaranteed pension after the age of 60.

By 2025, APY has become a reliable pension plan for millions of low- and middle-income citizens, helping them live with dignity and financial independence in old age.

✅ Main Objectives of Atal Pension Yojana 2025

The APY aims to create a safety net for India’s ageing population through these key objectives:

- Provide a guaranteed monthly pension between ₹1,000 and ₹5,000 after 60 years of age.

- Encourage retirement savings among workers in the unorganised sector.

- Reduce financial dependency on family members during old age.

- Promote social security awareness in rural and semi-urban areas.

- Ensure government-backed returns for risk-free retirement planning.

👥 Eligibility Criteria – Who Can Join APY?

The scheme is inclusive but targeted to reach those who need it the most.

| Criteria | Details |

|---|---|

| Age | Minimum: 18 years; Maximum: 40 years |

| Citizenship | Must be an Indian citizen |

| Account | Must have a savings bank account or post office account |

| Aadhaar | Recommended for KYC (mandatory for subsidies) |

| Occupation | Ideal for unorganized sector workers, but open to all |

💡 Note: The earlier you join, the smaller your monthly contribution for the same pension amount.

💰 Pension Benefits & Contribution Details

Under APY, the monthly pension depends on how much you contribute and for how long.

Guaranteed Pension Options:

- ₹1,000 per month

- ₹2,000 per month

- ₹3,000 per month

- ₹4,000 per month

- ₹5,000 per month

Contribution Example (For ₹5,000/month pension):

| Entry Age | Monthly Contribution | Years of Contribution |

|---|---|---|

| 18 years | ₹210 | 42 years |

| 25 years | ₹376 | 35 years |

| 35 years | ₹902 | 25 years |

💡 The sooner you start, the lower your monthly payment.

📄 Government Co-Contribution

To encourage enrolment, the government earlier provided 50% of the contribution (up to ₹1,000/year) for eligible subscribers who joined between 2015 and 2016. While this co-contribution period has ended for new applicants, it greatly boosted early adoption.

🛡️ What Makes Atal Pension Yojana 2025 Safe?

- 100% Government-backed pension guarantee

- Managed by the Pension Fund Regulatory and Development Authority (PFRDA)

- Amount credited directly to your bank account after age 60

- Nominee facility available for family security

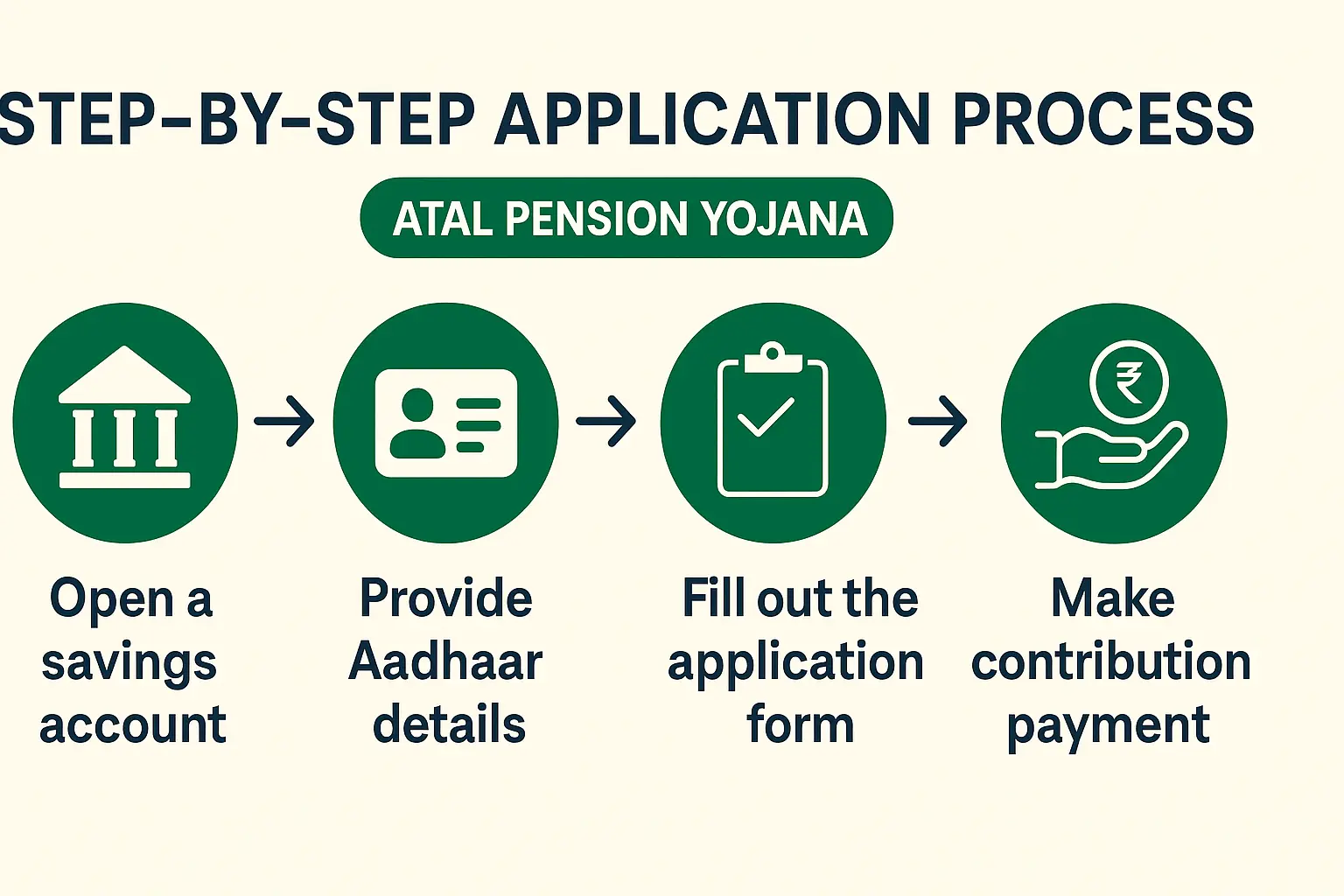

📝 How to Apply for Atal Pension Yojana 2025 – Step-by-Step Guide

Offline Method:

- Visit your nearest bank branch or post office.

- Fill in the APY registration form.

- Provide Aadhaar & mobile number for KYC.

- Choose your pension amount and contribution.

- Link to your savings account for auto-debit.

Online Method:

- Log in to your net banking or mobile banking app (if APY is supported).

- Go to Social Security Schemes → Atal Pension Yojana.

- Fill in details, choose a pension slab, and submit.

- Contributions will be auto-debited every month.

📜 Required Documents in Atal Pension Yojana 2025

- Aadhaar Card

- Bank savings account passbook

- Mobile number

- Age proof (if not on Aadhaar)

- Nominee details

Read more:

-

Pradhan Mantri Suraksha Bima Yojana 2025 – ₹2 Lakh Accident Insurance for Just ₹20

-

Delhi University UG Admissions 2025: Mid-Entry Window Opens — Your Last Golden Chance to Join DU

📞 Support & Helpline

- APY Toll-Free Number: 1800-110-069 (PFRDA)

- Contact your bank branch or India Post office

- Official Website: https://www.npscra.nsdl.co.in

❓ Common FAQs on APY

Q1. Can I increase my pension amount later?

Yes, you can upgrade or downgrade once a year (April–May).

Q2. What happens if I stop paying?

Your account will be frozen after 6 months, deactivated after 12 months, and closed after 24 months of non-payment.

Q3. Is APY only for poor people?

No, it’s open to all citizens within the age limit.

Q4. What happens to my money if I die before 60?

Your nominee will get the accumulated corpus or continue the plan until maturity.

🌟 Why Atal Pension Yojana is a Game-Changer in Retirement Planning

APY is not just another government scheme — it’s a guaranteed promise of security for your old age.

It removes the uncertainty of depending on others after retirement and promotes a culture of self-reliance.

For workers in the unorganised sector, it’s affordable, reliable, and government-backed, making it one of the most practical retirement solutions available in India.